Motorola which country brand. Global Marketing Motorola Term Paper

Global Marketing Motorola Term Paper

Motorola lost its No.1 position as mobile handset marketer in 2008. The financial figures for Motorola have not been grim for the company since 2008. The performance of the company has been continually deteriorating. According to analysts, the company faced a loss of 11 cents per share, and its sales figures fell by 28 percent in 2009.

We will write a custom Term Paper on Global Marketing Motorola specifically for you for only 9.35/page

808 certified writers online

Its sales were far behind the sales of closest competitors like Nokia, Samsung, and LG. The grim financial and sales figures indicate the ailing situation of the company and the with a highly fragmented handset worldwide market, Motorola faces dire challenge to regain its lost status.

Given the current bleak situation of Motorola, it is necessary to find ways to alter the current situation of the company. This paper is a case study on Motorola. The aim of the paper is to understand the present problems Motorola faces and the strategy it has taken to cater to its global market. The case will categorically try to identify areas where Motorola falls short to achieve growth. The paper will try to ascertain the reason why Motorola has been facing continual losses and will try bringing out ways it could recover from it.

The paper is divided into three parts. First, the paper will deal with the current situation of Motorola. The second section will analyse the current situation of Motorola. Based on this analysis strategic and tactical recommendations will be drawn for the company in the third section of the paper.

Current Situation

This section will demonstrate the current situation of Motorola. This section will begin with a brief background of Motorola Inc. and then describe the current situation. This will discuss the company’s financial situation and the steps the company has taken to revamp its present situation.

Business Background

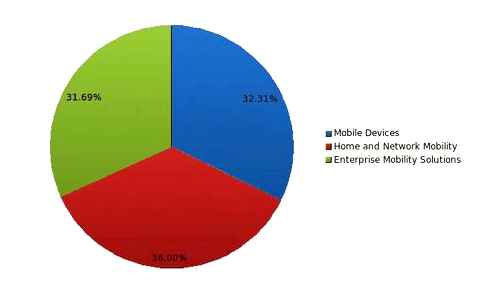

Motorola provides mobile solution for a large range of technology based product and services. Their business divisions are divided into three segments – “mobile devices”, “home and network mobility”, and enterprise mobility solutions”. The mobile devices segment manufactures and sells wireless mobile handsets and smartphones.

The mobile business segment is the second largest segment of the company comprising of 32 percent of the total revenue in 2009 (see figure 1). The largest segment is enterprise mobility and third is home and network mobility with 36 percent of net sales. This segment “designs, manufactures, sells, installs and services digital media products and wireless access systems”.

Figure 1: Share of Business segments in Net Sales, Source: Annual Report 2009

The network business takes care of end-to-end cellular network, radio bases stations, and allied software and services. The target customers for this segment are mobile phone operators, television operators, etc.

Financial Situation

The financial condition of Motorola has been in doldrums since 2007. The company faced growth until 2006 but started to fall since 2007. The negative growth has become larger and larger every year as the revenue growth rate continued to fall further down.

Figure 2: Revenue Analysis of Motorola

Financial Analysis of Business Segments

Figure 3 shows the segment wise revenue earned by Motorola from 2007 through 2009. The mobile device segment posted revenue of 18988 million in 2007, which comprised of 52 percent of the total revenue earned by the company. However, in 2008 it fell to 12099 million, and a share of 40 percent.

It slipped further in 2009 with a share of just 32 percent and overall revenue of 7146 million. The home and network mobility segment saw marginal growth in 2008 when it grew from 10014 million to 10086 million. However, it too fell to 7963 million in 2009. Similar trend has been observed by the enterprise mobility solution that increased its revenue in 2008, however fell by 4.5 percent. Therefore, Motorola’s segment wise revenue earnings have fallen for all segments in 2009.

However, the largest fall has been faced in the mobile devices segment. Figure 4 shows the segment wise operating profit (loss) from 2007 through 2009. The data demonstrates that the mobile devices segment of Motorola has constantly posted operating losses from 2007 through 2009, and the magnitude of the loss has been increasing constantly.

We will write a custom Term Paper on Global Marketing Motorola specifically for you! Get your first paper with 15% OFF

Figure 3: Segment wise revenue analysis

Figure 4: Segment-wise Operating Profit (Loss)

Financial Analysis of Geographic Segments

Motorola has its operations in various countries like the US, UK, China, Brazil, Israel, and others. According to the geographical division of the business of Motorola, it has the largest market in the US (54 percent) as in 2009. The net sales growth in all the geographic regions has been negative in 2008 and 2009 (see table 1). The largest fall in sales revenue has been in Brazil, China, UK, and in other nations. The sales figures have marginally improved in the US with decline in sales becoming less from 20.7 percent to 19.54 percent.

Table 1: Geographic division and financial analysis

The asset turnover ratio of the geographic division for 2009 and 2008 shows that the highest asset turnover ratio is for the other nations in 2009 with the ratio being 60.4, which increased from 9.1 in 2008. The lowest turnover ratio has been reported for the US, China, the UK, Israel, and Singapore. Low asset turnover in the regions mentioned may indicate that there is obsolescence and inefficiency in the regions. Thus, overall, a low asset turnover ratio indicates lower efficiency.

The share regional sales to net sales according to geographic areas of operation are presented in the following figure. The figure shows that the largest market for Motorola is the US. Europe, Asia, and Latin America form the second largest market for the company. This shows that the operations of Motorola are concentrated in one region i.e. the US.

The second largest market for the US becomes Asia (including China) forming 17 percent of the total sales. Therefore, the company may try to concentrate more on this region as Asian countries are developing very fast.

Figure 5: Percentage of local sales to total net sales in 2009, Source: Annual Report 2009

Not sure if you can write a paper on Global Marketing Motorola by yourself? We can help you for only 9.35/page

Performance Analysis

Figure 6 presents the performance ratio analysis of Motorola for the year 2005 through 2009. The analysis shows there has been a constant fall in the growth of revenue, and ultimately in 2007, the revenue started falling, as revenue growth became negative. This shows that the revenue performance of the company has been declining.

Figure 6: Performance Ratio Analysis of Motorola

The return on sales ratio measures the amount of profit generated per unit of revenue. This shows that the company’s profit to revenue return has been declining since 2005. The return on sales was 12.97 percent in 2005 that decreased to.0.13 percent in 2007 that declined to.0.23 percent in 2009.

Actually, the situation improved in 2009 as the ratio fell to.14.08 percent in 2008. This indicates that the company had been facing adverse environmental conditions and had failed to withstand it. The financial crisis of 2008 had created a crunch in overall market and increased costs all over the world. This condition led to a decline in the profit to revenue ratio of the company.

Figure 7: Cost of Sales and Net Sales of Motorola

The cost of sales and net sales of the company has declined. This actually indicates that overall production has declined, which may have been due to the adverse market conditions. The overall performance of the company has declined over the period. This is evident from the lowering of the performance ratios – return on sales and return on asset ratios.

Therefore, there are evident that internally Motorola was not strong enough to handle the flux in the market conditions that led to a Rapid decline in the performance of the company. In the next section, the reason for the bad performance of Motorola is dealt with elaborately. The overall performance of the company has been bad and some reasons for it has been discussed in the next section.

Related marketing problems

Internal Problems

The main problem faced by the company is due to a weak product portfolio, especially for mobile devices. There was a slump in demand for Motorola phones in 2007 and 2008 due to inadequate model or product offering in emerging mobile segments like 3G and Smartphone segment.

With the new Android software platform introduced by Motorola, it has just 8 phones that have web browsing facility and 7 of them have been recently launched on Android platform. Further, a lack of FOCUS on smartphones had led to lower demand of Motorola phones. Though the Smartphone market is expected to grow from 1.2 billion units in 2009 to 1.5 billion units in 2012. However, Motorola stresses more on featured phones than on Smartphones.

External Problems

Uncertain economic and political conditions globally have increased the problems for Motorola. The financial crisis that crippled the western world and shrunk the US unemployment level had adverse effect on product demand for Motorola. Further the uncertain political condition in the Middle East. The manufacturing and engineering setup that the company has in Israel may be disrupted due to the political extremism in the region.

The global financial crisis led to a credit crunch resulting in reduced business from 2008 through 2009. Due to unavailability of credit, the Motorola customers could not obtain finance to run their business, and therefore, there was a lowering of the product demand. Therefore, global economic conditions had an adverse effect on the company performance. Telecommunication industry has faced a slowdown in 2009, which had an adverse effect on the financial performance of Motorola.

Another external problem observable is due to the convergence of the telecom, data, and broadband industry that was driven to advancement of new IP-based technology. This led to changes in the market, and Motorola, unable to understand the market developments, had negative impact on their business.

Strategic marketing solution

Industry Analysis

The marketing for Motorola and its business segments are divided into three business areas, facing different industry structure. However, the mobile market can be analysed using porter’s five forces model (see figure 8). The industry analysis shows that mobile industry has a high degree of competition within the industry, as there are a number of mobile device makers.

Figure 8: Porter’s Five Forces Model

The bargaining power of the customers is high, as there are a large number of mobile brands, and customers get a large number of options to choose from. As there are few suppliers supplying key technology and raw material, the bargaining power of suppliers is high. For instance, Google supplies Android software platform to Motorola.

Google being the sole supplier of the software has a high bargaining power. This increases the bargaining power of the suppliers. Further, the threat of new entrants is high as there are new players who are entering the mobile market like Apple, Microsoft, HP, etc. the attractiveness of the mobile market is in its expected growth and the possibilities of mobile commerce.

The industry faces a high threat from substitutes, as there are many substitute products for mobile phones such as traditional telephones, or the internet that provides possibilities of Internet telephones, etc. therefore, the mobile industry is highly competitive, and operation in the industry would involve constant up gradation of technology and new product development.

SWOT Analysis

Figure 9 presents the SWOT analysis for Motorola. They are discussed in detail in the next paragraph.

Research and Development

Research and development (RD) is a strong point for Motorola. It has significant capability in developing RD and transforming them into new product, nurturing product innovation. There is constant interaction and exchange of innovation and ideas between its business segments that helps in constant development.

The RD expenditure of the company was 14.4 percent of net sales in 2009, which increased from 13.6 percent of net sales in 2008. However, due to cost reduction strategy the absolute RD expenditure was reduced. Further, the company owns almost 9907 patents in the US, which are used in its operations.

The high stress on RD has helped Motorola to develop new products and achieve excellence in developing new products. For instance, the company has developed WiMAX that helps users to transfer at fraction of the cost of transferring multimedia file in 3G. Further with Motorola’s new contract with Google to use its Android-OS platform for its Smartphones.

This is expected to change Motorola’s position in the Smartphone segment of the mobile device market. Further, Motorola also developed the new TETRA portfolio for its enterprise segment, in order to provide greater safety, security, and efficiency to its users. New features that have been included in this are “over-the-air programming”, voice, and TEDs.

Motorola is expected to launch tablet TV that would increase its offering in the home mobility segment. Therefore, Motorola’s strong position in developing new products through research in new technology and innovation will help it to enhance its competitive position in the market.

Strong Brand

The brand image of Motorola is very strong. Motorola has launched many marketing campaigns to enhance its brand equity. Motorola has recently launched its advertising campaign for Motorola DEXT with MOTOBLUR campaign. Therefore, in order to remain competitive at all price points and maintain brand awareness to all customer segments, Motorola develops mobile devices available at all price points.

In order to create greater degree of brand equity, Motorola does direct to consumer promotion in order to emphasize on Motorola brand. The advertising expenditure of the company amounted to 412 million, 790 million, and 1.1 billion in 2009, 2008, and 2007 respectively. Further customer targeted advertising helps the company to achieve greater brand recall and creates a more positive and strong brand image.

Strong Liquidity

The company has a strong liquidity and balance sheet. As stated in it Annual Report, 2009: “We remain very focused on the strength of our balance sheet and our overall liquidity position. We believe we have more than sufficient liquidity to operate our business.” In 2009 cash and cash equivalent, that the company held was 2.9 billion.

Recent Acquisitions

The home and network mobility segment acquired assets of “Zhejiang Dahua Digital Technology Co, Ltd. And Hangzhou Image Silicon”. this acquisition would help the company to develop and strengthen its position in the cable market, especially in China. Further, in 2008, Motorola acquired interests in vertex Standards Co. Ltd. and AirDefense Inc. for their radio and security solutions.

Motorola acquired Symbol Technologies, Good Technology, Netopia, and Terayon Communication Systems in 2007. These acquisitions are expected to help and enhance marketing and product development in their particular segments.

Weaknesses

Weak Product Portfolio

Even though Motorola is one of the largest players in the mobile device market, it has a very weak portfolio of mobile devices. In 2007 and 2008, there was a significant decline in the demand for Motorola phones due to weak portfolio. Until 2009, there was no mention of smartphones in the product portfolio of Motorola, despite the growing demand for Motorola phones.

Motorola has stressed more on feature phones, while the market trend was moving towards Smart phones. Further, Motorola was late to anticipate the shift in the demand from voice centric devices to data centric devices due to the increased demand for 3G and smartphones. However, in 2008, Motorola tried to revive its product portfolio with increased devices like CDMA and iDEN handsets.

There was a slump in demand for Motorola phones in 2007 and 2008 due to inadequate model or product offering in emerging mobile segments like 3G and Smartphone segment. With the new Android software platform introduced by Motorola, it has just 8 phones that have web browsing facility and 7 of them have been recently launched on Android platform. Further, a lack of FOCUS on smartphones had led to lower demand of Motorola phones.

Further, Motorola phones were heavy on features, whereas lower on longevity. The mobile devices faced this problem. Further, there was a brand diminution as Motorola’s brand depleted.

They also made smartphones on Android and Microsoft platform. However, they failed to prevent revenue fall due to increased market presence and acceptance of non-traditional competitors like Apple, HC, Palm, etc. in higher end Smartphone market and South Korean players like LG and Samsung in lower-end market. This resulted in weak financial performance of the mobile device segment.

Negative Credit Rating

The credit rating of Motorola, both in short-term and long-term has been downgraded in 2009. Therefore, the company has faced problems in getting finance from third party due to low credit rating. The credit rating has been very low. This has created problems for the company.

Standard and Poor (SP) has rated Motorola in non-investment grade for long-term debt. Rating given by Fitch and Moody’s Investor Research rated the long-term debt gave the lowest rating for investment and F-3 for short-term debt. This limited the access of Motorola to generate long-term debt. Further, this also limited the ability to generate performance bonds, bids, surety bonds, etc.

Opportunities

Next generation technology solutions

Technology convergence has provides greater ability to increase the ease of innovation. The company has entered into the next generation technology, with telecom providers stepping into the data services with increased broadband. Therefore, there is a convergence of the mobile devices from voice based to data based features. Therefore, growth in next generation mobile technology will ensure steady revenue.

Market Growth in Developing Countries

Developing markets like china and India have started to their expand their 3G infrastructure therefore providing new avenue for the mobile device industry.

New technology and 3G enabled devices are expected to become more in demand in these regions, thus, providing opportunities for investment in these regions. Growth opportunity that is offered in developing countries of Asia and Latin America will provide the vehicle of growth for Motorola.

Threats

High competition in mobile market

Industry competition is high in the mobile device industry, as there are many non-traditional players like Apple, HTC, Palm, etc. who have entered the higher end market, while others like LG and Samsung have captured a substantial market share in the lower-end price point.

Competitors in the higher end or Smartphone segment are Nokia, Apple, HTC, Palm, RIM, and Samsung. In the lower-end segment, the competitors are Nokia, Samsung, LG, and Sony Ericsson. Further, many mobile phone operators provide mobile phones under their own brand name like Alcatel, Virgin, Huawei, etc. therefore the market is highly competitive for Motorola.

Economic Slowdown

Economic slowdown in North America and Europe has crippled many industries. Sluggish growth in most developed countries in 2009 led to a lower product demand in both 2008 and 2009. Economic slowdown is expected to continue to reduce demand for products and services in near future.

Uncertain political condition in Middle East

Middle East comprises of 6 percent of the net sales of Motorola. Further, it has a plant in Israel. However, political and terrorist problems in the region may lead to disruption of production, as well as reduce demand in the region. This is expected to reduce the demand for Motorola products largely.

Competitor Analysis

Competition in the wireless mobile handset market is very high with competition from non-traditional players increasing. Competitors in the higher end or Smartphone segment are Nokia, Apple, HTC, Palm, RIM, and Samsung. In the lower-end segment, the competitors are Nokia, Samsung, LG, and Sony Ericsson.

Further, many mobile phone operators provide mobile phones under their own brand name like Alcatel, Virgin, Huawei, etc. therefore the market is highly competitive for Motorola. In 2009, Motorola remained the fifth largest market shareholder. In 2009, the market share of Nokia was 7 percent in Smartphone segment. Motorola currently has a market share of 6 percent. The market condition in the mobile device market is highly competitive.

Marketing strategic recommendation

This section provides recommendations for Motorola based on the above analysis of the company. The strategic marketing recommendations that are derived are –

Motorola must develop Smartphones and invest more in RD in order to enhance its product portfolio. Further, companies like Apple, HTC, and Palm have gained market share using touch-based smartphones. As the mobile device technology are moving to next generation technology based on data, new technology like HD programming and VoIP must be adopted by the company to remain competitive.

This technology has allowed operators to optimize their bandwidth. In mobile technology, the industry has shifted to UMTS and WiMAX technology. Therefore, Motorola must be ahead of them in order to gain a greater market share.

Motorola must concentrate on developing countries for increasing its market as new technological advancement in the developing countries provides a greater market. Further, the North American market is the largest market for the company. The GDP growth of the US, which is Motorola’s largest geographic market, was just 1.1 percent in 2008 and 2.6 percent in 2009. That in Canada was just 0.4 percent in 2008 and 2.3 percent in 2009.

The Euro region grew by just 0.8 percent in 2008 and 4 percent in 2009. Slow growth rate led to weak consumer demand in the developed countries leading to reduced demand. Therefore, the company should concentrate on the market of the regions where the economic recession has not strongly affected consumer demand, and this is observable in developing countries like India and China.

The brand equity of Motorola has depleted considerably due to the lack of strong software base of its hit model Razr. Therefore, product development and targeted advertising must be done in order to regain brand equity. Strong brand equity will help in market penetration and product demand.

In order to remain competitive at all price points and maintain brand awareness to all customer segments, Motorola develops mobile devices available at all price points. Brand equity can be increased by increasing direct to target consumer promotion in order to emphasize on Motorola brand.

The customer targeted by Motorola should make different products for different targeted segments. For instance the young segment below 25are more interested in multimedia phones, and other data services like MMS, SMS, game, song download, etc.

Whereas, the people above 35 and below 60 may be interested in interested in smartphones, while older customer segment want voice based, basic mobile phones. Therefore, customer targeting must be done and products should be made based on the specific need of the target segment.

Marketing tactical recommendation

The tactical strategy that the company must undertake as follows:

- Motorola targets both the lower and higher-end customer segment. Customer segmentation must be done such that the products are targeted t the right kind of customers. For instance, in the US, people over 65 are essentially looking for voice-based handsets, while the age group below 24 years used their phones only for voice. However, the age users within the age groups of 19-24 used mobile phones for multimedia services like MMS, music download, etc. the age group between 35 to 44 years used data services. Therefore, the products must be targeted according to the customer demand.

- The marketing mix adopted by Motorola should be as follows:

- Price – differentially placed and targeted to the right customer segment. The Smartphone pricing is vital, as the largest competitors like Apple, Palm. HTC, and Blackberry have their product pretty high, however, Nokia’s smartphones are moderately priced. Therefore, a more moderate approach to pricing can target a larger segment of the market, which has not yet used the more expensive iPhone of Blackberries.

- Promotion – Targeted advertising and promotional activities will help in building brand image. In order to create greater degree of brand equity, direct to consumer promotion is necessary to emphasize on Motorola brand. This would help the company to achieve greater brand recall and creates a more positive and strong brand image.

- Product – Innovation and widening of the product offering will give customers greater options to choose from and concentration on new technological solution like Android based smartphones and Cloud-based MOTOBLUR. Android-based smartphones can become the prize winner for Motorola as Android has gained more market share in the US than Apple’s iPhone in the US.

- Place – Motorola must concentrate on specific regions like the developing countries of Asia and the US. Manufacturing should be dispersed and shifted to areas where cost of production is low. This would increase the possibility of increasing the profit margin of the company.

Conclusion

The case study demonstrates the problems and issues faced by Motorola due to internal and external constraints. The industry, company, and competitor level analysis demonstrates the strategically imperative that the company must undertake in order to become more successful. The paper also provides significant recommendations for the company. The case study provides greater understanding of the current situation of Motorola and provides recommendations to solve the issues.

References

CED, 2010. Game changing at Motorola. CED, March. p.6.

Datamonitor, 2009. Global Mobile Phones. Industry Profile. New York: Datamonitor.

Datamonitor, 2009. Global Mobile Phones. Industry Profile. New York: Datamonitor.

Gardner, W.D., 2008. Motorola Expected To Lose No. 1 U.S. Handset Position. Web.

Motorola. 2007. Annual Report. Annual Report. Motorola.

Motorola Inc., 2010. Motorola Expands Low Teledensity WiMAX Deployment Options for Small Operators. Web.

Motorola Inc., 2010. Motorola Launches Advertising Campaign for MOTOROLA DEXT™ with MOTOBLUR™ in Mexico. Web.

Motorola, Inc., 2010. Motorola Launches Next Generation of Mission Critical Terminals With the MTM5400 TETRA Radio. Web.

Motorola, 2008. Motorola Annual Report. Annual Report. Motorola.

Motorola, 2010. Mobile Device Home. Web.

Motorola, 2010. Mobile Phones. Web.

Motorola, 2010. Motorola Inc. 10-K. Annual Report. Motorola.

New York Times, 2010. Motorola Inc. Web.

Palenchar, J., 2010. Motorola Debuts Android Plans. [Online] EBSCO. Web.

Paul, I., 2010. Motorola and Verizon To Launch TV Tablet, Report Says. Web.

Shankar, V., 2008. Motorola Credit Rating Is Downgraded to Junk by SP. Web.

Svensson, P., 2009. Motorola Loss Widens; Analysts See Worrisome Signs. Web.

Voight, J., 2010. What the duel between Google and Apple’s operating system? means for brands. Adweek, Vol. 51, No. 26, 28 June. pp.10-12.

Appendices

Table 2: Historical Financial highlight of Motorola, Source: Annual Report 2009

Table 3: Segment-wise performance

Table 4: Geographical segment wise performance of Motorola

History of mobile phones and the first mobile phone

Although most of us feel like we couldn’t live without our mobile phones, they’ve not really been in existence for very long.

In fact, mobile phones as we know them today have only been around in the last 20 years.

When were mobile phones invented?

Mobile phones, particularly the smartphones that have become our inseparable companions today, are relatively new.

However, the history of mobile phones goes back to 1908 when a US Patent was issued in Kentucky for a wireless telephone.

Mobile phones were invented as early as the 1940s when engineers working at ATT developed cells for mobile phone base stations.

The very first mobile phones were not really mobile phones at all. They were two-way radios that allowed people like taxi drivers and the emergency services to communicate.

Instead of relying on base stations with separate cells (and the signal being passed from one cell to another), the first mobile phone networks involved one very powerful base station covering a much wider area.

Motorola, on 3 April 1973 were first company to mass produce the the first handheld mobile phone.

These early mobile phones are often referred to as 0G mobile phones, or Zero Generation mobile phones. Most phones today rely on 3G or 4G mobile technology.

Landmarks in mobile history

Mobile telephony has a long history that started off with experiments of communications from and to moving vehicle rather then handheld devices.

In later years, the main challenges have laid in the development of interoperable standard and coping with the explosive success and ever increasing demand for bandwidth and reliability. By tracking how mobile phone statistics have changed over time, we are able to see how these devices have evolved to the smartphones we use today.

1926: The first successful mobile telephony service was offered to first class passengers on the Deutsche Reichsbahn on the route between Berlin and Hamburg.

1946: The first calls were made on a car radiotelephone in Chicago. Due to the small number of radio frequencies available, the service quickly reached capacity.

1956: The first automated mobile phone system for private vehicles launched in Sweden. The device to install in the car used vacuum tube technology with rotary dial and weighed 40Kg.

It had a total of 125 subscribers between Stockholm and Gothenburg.

1969: The Nordic Mobile Telephone (NMT) Group was established. It included engineers representing Sweden, Denmark, Norway and Finland. Its purpose was to develop a mobile phone system that, unlike the systems being introduced in the US, focused on accessibility.

1973: Dr Martin Cooper general manager at Motorola communications system division made the first public mobile phone call on a device that weighed 1.1Kg.

1982: Engineers and administrators from eleven European countries gathered in Stockholm to consider whether a Europe wide digital cellular phone system was technically and politically possible. The group adopted the nordic model of cooperation and laid the foundation of an international standard.

1985: Comedian Ernie Wise made the first “public” mobile phone call in the UK from outside the Dicken’s Pub in St Catherine’s dock to Vodafone’s HQ. He made the call in full Dickensian coachman’s garb.

1987: The Technical specifications for the GSM standard are approved. Based on digital technology, it focused on interoperability across national boundaries and consequent different frequency bands, call quality and low costs.

1992: The world’s first ever SMS message was sent in the UK. Neil Papworth, aged 22 at the time was a developer for a telecom contractor tasked with developing a messaging service for Vodafone. The text message read “Merry Christmas” and was sent to Richard Jarvis, a director at Vodafone, who was enjoying his office Christmas party.

1996/97: UK phone ownership stood at 16% of households. A decade later the figure was 80%. The explosion in growth was in part driven the launch of the first pay as you go, non-contract phone service, Vodafone Prepaid, in 1996.

1998: The first downloadable content sold to mobile phones was the ringtone, launched by Finland’s Radiolinja, laying the groundwork for an industry that would eventually see the Crazy Frog ringtone rack up total earnings of half a billion dollars and beat stadium-filling sob-rockers Coldplay to the number one spot in the UK charts.

1999: Emojis were invented by Shigetaka Kurita in Japan. Unlike their all-text predecessors emoticons, emojis are pictures. The same year in the UK sees the first shots fired in a supermarket price war, with Tesco, Sainsbury’s and Asda selling Pay and Go phones at discounted prices. For the first time, you could pick up a mobile phone for just under £40.

The first BlackBerry phone was also unveiled in 1999. Famous for its super-easy email service, BlackBerry handsets were seen as the ultimate business tool, allowing users to read and respond to emails from anywhere. This led to 83% of users reading and responding to work emails while on holiday, and over half admitted to sending emails on the toilet, winning the manufacturer the nickname CrackBerry.

2000: The all-conquering Nokia 3310 crash landed on shop shelves. Naturally it was unscathed and went on to sell 126 million units. Over in Japan, the first commercially available camera phone The Sharp J-SH04, launched in November 2000 in Japan. The only snag? you could only use it in Japan. Europe wouldn’t get its first camera phone until the arrival of the Nokia 6750 in 2002.

2003: The 3G standard started to be adopted worldwide, kicking off the age of mobile internet and paving the way for the rise of smartphones. Honk Kong-based Hutchinson Wampoa owned Three brand offered the first 3G network connection in the UK among other countries. Staying very much on-brand, Three ranged a trio of 3G handsets, namely: the Motorola A830, the NEC e606 and NEC e808.

Nepal was one of the first countries in southern Asia to launch 3G services. One of Nepal’s first companies to offer the service, Ncell, also covered Mount Everest with 3G.

2007: The iPhone debuted. Solely available on O2 at launch in the UK and priced at a then eye-watering 499, Nokia CEO confidently dismissed it as little more than a ‘cool phone’ that wouldn’t translate column inches into market share.

2008: The first Android phone turned up, in the form of the T-Mobile G1. Now dubbed the O.G of Android phones, it was a long way from the high-end Android smartphones we use today. Not least because it retained a physical keyboard and a BlackBerry-style trackball for navigation. This year also saw the advent of both Apple’s App Store and Android Market, later renamed Google Play Store, paving the way for our modern-day app culture and creating a 77 billion industry.

2009: O2 publicly announced that it had successfully demonstrated a 4G connection using six LTE masts in Slough, UK. The technology, which was supplied by Huawei, achieved a peak downlink rate of 150Mbps.

WhatsApp also launched that year, letting customers send and receive calls and messages via the internet. The messaging system now has 1.2 billion users sending more than 10 billion messages a day. Which makes it 50% more popular than traditional texting.

2010: Samsung launched its first Galaxy S smartphone. Usurping former Android giants, HTC, the Samsung Galaxy S range is still the most popular Android brand.

2012: When text messages first arrived, most people didn’t think they’d catch on. Ten years later, Britons were sending a billion messages per month. In 2012, British text volume reached its highest point, with 151 billion sent in the UK alone.

2016: The Pokemon Go app launched worldwide. The free augmented reality game uses the smartphone camera and location to show Pokemon characters in the real world. The aim of the game is to travel to different locations to collect as many Pokemon as possible, leading countless gamers to walk into lamp-posts in their quest to catch ‘em all.

2017: The Nokia 3310 had a revival, sporting a fresh version equipped with basic web browsing, a colourful screen and even a camera. Despite this, it still retained our favourite features from the original 3310, including the iconic design, super-long battery life and even an updated version of Snake. Needless to say, it stole the show at the Mobile World Congress (MWC) tech expo and was one of the biggest hits of the year.

Apple marked ten years in the smartphone game with the all-screen iPhone X and ditched a physical home button for the first time.

Landmark phones: the handsets that made history

From ‘80s menhir-like “brickphones” to the iconic Nokia handsets, these are some of the phones that pushed the boundaries of what was possible and paved the way for today’s smartphones.

1985: Motorola Dynatac 8000X

Known in the industry as “the brick” and visible in many scenes of the 1987 movie Wall Street, the Motorola Dynatac 800X was the first handheld mobile phone and loudly announced the beginning of a new era.

The price? An eye-watering £3,000.

1992: Nokia 1011

The world’s first mass produced phone that used the new GSM digital standard, the Nokia 1011 was ‘available in any colour, as long as it’s black’.

Specs included a monochrome LCD screen, extendable antenna and a memory capable of storing 99 phone numbers.

1996: Motorola StarTAC

The most expensive and desirable phone on the market at the time of its release, the StarTac debuted the clamshell design and was the lightest and smallest phone on the market.

It was also the first phone to be openly marketed as a luxury item.

1997: The Hagenuk GlobalHandy

This little known German-made and impractically minimal handset was the first phone that had no visible external antenna.

1998: Siemens S10

The first phone with a colour screen, Siemens’ S10 was a landmark device by any yardstick.

Although its uninspiring design and tiny 97 x 54-pixel display failed to set the world on fire, it more than merits a place in the annals of mobile phone history.

1998: Nokia 5110

Sponsor of London Fashion Week in 1999, it was an instant success and kickstarted the vogue for customising your handset.

1999: Nokia 7110

Another first for the Finnish phone-maker, the 7110 was the first handset to feature a WAP browser.

That meant it was capable of browsing the internet. Or at least a stripped down and incredibly slow version of it that was of little use to most people.

But for all that, it was a big step towards the multi-functionality that’s at the core of today’s smartphones.

1999: Motorola Timeport

This was the first tri-Band GSM phone, meaning it worked everywhere around the world.

A must-have for self-proclaimed citizens of the world. And the hordes of Gen X-ers heading to Asia on the backpacker trail. As was the fashion of the time.

2000: Nokia 9210 Communicator

The first serious attempt at an internet-enabled mobile phone, the Communicator was ahead of its time.

It weighed around 400g, so was no-one’s idea of.sized. But on the plus side, it had 8MB of storage and a full keyboard, you could use it as a personal organiser, as well as a web browser and email support.

2000: Sharp J-SH04

Billed as the first commercially available camera phone, Sharp’s effort was only sold in Japan and had a camera resolution of 0.11MP. ‘Blurrycam’ didn’t begin to cover it.

2000: Nokia 3310

Legendarily sturdy, the 3310 was the phone that launched a thousand memes. And with 126 million units shifted, stands as one of the biggest-selling phone of all time.

The battery lasted for days and it was light and truly able at only 133g.

It also introduced the Snake game, customisable ringtones and a silent ‘vibrate’ mode.

2003: Nokia 1100

The Nokia 1100 was launched as a basic phone for developing-world countries back in 2003.

The best part of a decade and a half and one smartphone boom later, it remains the best selling mobile phone of all time.

2004: Motorola Razr V3

The last great flip phone, the Razr was impossibly thin at only 14mm. Unusually for the time, it also had an aluminium casing that looked achingly slick.

Ironically, the overwhelming success of the Razr was probably the main cause of the downfall of Motorola.

In hindsight, it’s apparent that the US phone-maker’s over-reliance on this successful and iconic series caused the company to fall behind, failing to innovate and compete with the soon-to-arrive large-screen phones from LG and Samsung.

2003: Blackberry 6210

The first true Blackberry phone, which integrated a phone with fully functioning email, web browsing and the much loved Blackberry Messenger.

The Nokia years

Tracing its heritage to paper production, Nokia entered the telecommunications industry first as a supplier of telecommunications equipment to the military and entered the mobile market in the late ‘80s.

Released in 1987, the Mobira Cityman brickphone was Nokia’s answer to the Motorola Dynatac and was an early hit for the nascent company.

But as Nokia’s first GSM phone, the 1011 in 1992, and 1994’s 2100 model that precipitated the Finnish giant’s rise to the top.

Marketed to the business market, the 2110 featured the design that came to be known as the “candybar” format.

It was the lightest and smallest GSM phone available at the time and featured the easy-to-use Nokia menu system.

It was also the first phone to offer a choice of ringtones and marked the debut of the melody that came to be known as “the Nokia ringtone”, based on the Grand Valse composition for classical guitar.

In the ‘90s, Nokia released more handsets than any of its rivals and in 1998 overtook Motorola to become the best-selling mobile phone brand in the world.

By the middle of 1999, Nokia’s Expression series comes to dominate the market with the release of the 3210.

The 3210 was the first to popularise the unmistakable small-candybar shape which was the work of British designer Alastair Curtis.

Its relatively low cost, under £200 on release in the UK, but a lot less by the end of 2000, meant this 3210 was affordable for young people and folk who’d been shut out of the mobile phone market until now. The result was 160 million sales worldwide.

Within a year, the smaller 3310 was released. It was not a revolutionary update from its predecessor, but its compact design, four built-in games (Pairs II, Space Impact, Bantumi, and Snake II) and the fact it could support long SMS messages of up to 459 characters made it a success.

But it was the phone’s sturdy construction and legendary reliability that turned it into an enduring cult. And the best part is, 20 years later, still inspires memes and favourable comparisons to fragile, modern-day smartphones.

Capitalising on a wave of nostalgia, in 2017 Nokia announced the release of an all-new 3310.

Featuring an updated design based on the original candy bar shape, the 3310 version 2.0 added a large 2.4-inch LCD screen, rear camera and an astonishing 25-day standby battery life.

Marketed both as a tribute to the original as well as an alternative to ever-more complex, more advanced smartphones, the new 3310 was priced at around £50 SIM free and was a moderate commercial success.

The spread of 2G technology and the early success of Blackberry phones inspired Nokia to experiment with physical QWERTY keyboards.

The 6800 was notable with its unusual fold-out keyboard, with built-in email and support for Blackberry emails.

The early 2000s were also a time of wild experimentation and Nokia seemed to aim at to release a phone to suit every taste.

It was also the era when mobile phones became fashion accessories and the company certainly wasn’t afraid to bring to market phones with an accent on style. Arguably over substance.

Take the roughly square 7600, for instance. Its shape meant it was difficult to hold in one hand. And because you had to hold it at an angle, it was hard to make calls too.

Then came the 5510 which was essentially a keyboard-shaped phone. Nokia was aware that the shape was seen as unconventional, to say the least.

So much so that in their flagship advertisement for the 5510, the phone is barely shown and the ad closes with the slogan “Looks weird, sounds right”.

The 3650 was one of the early experiments with a keyboard layout. It was marketed as a high-end phone, but the rotary-styled keypad design made it hard to use for texting.

Next was an even stranger layout in the shape of the 2300, which was a basic phone with key shapes that didn’t seem to follow any logic.

A relatively ordinary variant on the 3100 series, the 3220 had a system of LEDs on the sides that could be set up to flash in different colours.

On first impressions, 2007’s Xpress Music featured a fairly standard form factor. But the twist was that the camera could only be enabled by swivelling the bottom half.

Probably the oddest of the lot, the 7280 had neither a touchscreen or a keypad. And if you wanted to send a text message, you had to scroll through each letter with a physical spin dial.

It wasn’t until the N95 in 2006 that Nokia released what could truly be termed a smartphone. It came with the longest list of features you could imagine at the time: Wi-Fi, web browsing, a five-megapixel camera and even built-in GPS.

It sold well, registering over 1 million sales in the UK alone. And for a few months, it seemed Nokia had managed to keep Blackberry’s challenge at bay while establishing a new benchmark of what a mobile phone could and should offer.

But the good times weren’t to last. 2007 saw the release of the iPhone, ushering in the touchscreen era and making Nokia’s Symbian operating system and its reliance on drill-down menus seem cumbersome.

The development of mobile phone technology

The first mobile phone invented for practical use was by a Motorola employee called Martin Cooper who is widely considered to be a key player in the history of mobile phones.

Handsets that could be used in a vehicle had been developed prior to Martin Cooper’s phone, but his was the first usable truly portable mobile telephone.

Cooper made mobile phone history in April 1973 when he made the first ever call on a handheld mobile phone.

17 and beyond

Modern-day smartphones are pretty unrecognisable from the analogue bricks we used to cart around.

The likes of 2017’s iPhone X and Samsung S8 have brought us stunning all-screen fronts that are perfect for watching videos and playing games. Meanwhile, their face-scanning technology enables you to unlock your device just by looking at it.

Professional dual-lens cameras are now becoming standard on high-end smartphones while the handsets themselves are becoming ever more durable, with impressive waterproofing and tough Gorilla Glass screens.

Yet despite all this, Nokia’s 2017 revival of its old classic, the Nokia 3310. was perhaps the most talked-about phone of the year, heralding in a wave of nostalgia for older, simpler devices.

Want to find out what’s coming our way next? Read all about the future of mobile phones

Compare mobile contracts and SIM only deals

Browse our best contract deals for the latest handsets or save money with a cheap SIM only offer.

Is Motorola afraid of competing with Samsung and Apple? The confusing tale of how not to make a flagship

There’s a question on my mind. It has been a question of mine for years now. With the many releases of Motorola’s long-awaited flagships that turned out to be nothing more than higher mid-rangers, this question kept on bugging me more and more.

We’ve come to the point where the best Motorola phones aren’t sold in the USA. Actually, some of them aren’t present in Europe either. The illogical, for me, decisions of the Lenovo-owned brand have continuously led me to the question not many dare to ask: Is Motorola afraid of competing with the big boys?

Is there a duopoly in the US market, or am I starting to imagine things or simply overthinking the mobile business yet again? What does the future hold for Motorola anyway? Here are my sincere thoughts as a long-time fan of the once American-owned legendary phone maker.

Why Motorola flagships never sold well

Remember the OG Motorola Moto X? The 2013-released smartphone was the first Motorola with Android I ever owned. Under the brief ownership of Google, the iconic phone brand released great smartphones with a clean user interface, timely updates, no bugs or glitches, and a real brand identity design-wise. Then there was the Google Nexus 6, based on Motorola’s second generation Moto X device, which wasn’t bad either.

But it all went downhill since then, especially in the states. You must agree that despite a strong and loyal fanbase, Motorola cast itself as an outsider with forgettable marketing and devices and also risky ideas of modular phones which didn’t stick.

Motorola’s Moto Z flagship phones were supposed to give the brand a real shot at competing in the premium segment. But interesting design decisions, slim bodies, and Moto Mods were not what the consumer market needed.

The thing is, by that point, there was no question as to what a successful smartphone should offer. Samsung and Apple have paved the way, resulting in millions of high-cost phone sales. So what made users look away from the Moto phones?

Well, we already mentioned the not-so-attractive marketing of the devices, but even if that wasn’t the case, the Motorola flagship had some much bigger fish to fry before becoming a contender for the crown.

While offering a clean user interface with timely updates and unproblematic performance is necessary, areas like the camera department and battery performance seemed to ask you to make a compromise. For a flagship to be great, one should not sacrifice in any aspect.

Unfortunately, to this day, Motorola is always behind with its camera systems. The Moto Z Hasselblad mod was simply a bandaid on a wound that needed at least ten stitches. The wound itself was the Moto Z phones’ below-Apple and Samsung camera performance.

And what about the Moto Mods? Steve Jobs once said, “Who wants a stylus”? Well, during the Moto Z era, I was asking myself who wants to stick thick mods to their phone.

After years of disappointing sales of the Moto Z lineup, Motorola (or Lenovo) decided to pull the plug. Unfortunately, it only got worse.

Motorola’s flagship hiatus or how to make people forget you exist

If a Motorola rep is reading this, they might be thinking, “What is this guy on about? We never took a hiatus from making flagships.” But they’ll be wrong.

See, in the Moto Z years, Motorola didn’t release any other flagship phones in the states. And if you’re thinking the Moto Z lineup was their flagship lineup, and they kept on releasing new generations for years, you are correct. But at the same time, you are also very wrong.

The Moto Z lineup had a huge flaw. Its idea limited the room for improvement in each new generation more and more. There were a total of four generations of Moto Z flagships, but guess what? These were all pretty much the same phone, at least from the outside.

For the older Moto Mods to be able to work with each new generation or iteration of the Z phone, Motorola needed to keep the same design for years. This means the same size, the same shape, and even the same choice of materials.

As you know, in the smartphone business no design lasts more than a year or two, and Motorola kept at it with its premium segment for four years!

Four years of meaningful (for Motorola) upgrades that were invisible to the public eye. Not everyone is a tech enthusiast who understands spec bumps and new innovative software features. In fact, most people don’t even know how much storage they have on their phones.

You might be wondering why this is a problem considering that during these years Apple released the iPhone X, XS, and 11 Pro, which were also left with a very similar design and almost identical dimensions.

Well, Motorola is no Apple. You have to have been producing the best smartphones in the business for years. You’ve got to have this reputation for great premium flagships and a mass of people invested in your ecosystem. Also, Apple’s design allowed it to make more iterations to the design while still using the same body, like adding cameras, sensors, and connectors. Motorola never had any of these traits. It didn’t have its own operating system, it never made the best smartphone there is, let alone making it more than once. The Moto Mods didn’t allow for a camera module redesign either.

That’s why I called this the Motorola flagship hiatus. Was it that it simply misjudged the smartphone market during the time? Or was it a case of one being so hung up on something that left them clueless about what’s happening outside their bubble? Or was Motorola simply lazy?

On the edge of neglect

Here comes the current Motorola Edge era. I guess that after finally realizing the Moto Z series isn’t the real deal, the brand had to move on, but in what direction?

Well, the OG Motorola Edge and Edge Plus from 2020 were nothing short of amazing-looking smartphones. These packed great specs, they were priced well and had good camera systems. So what went wrong?

The answer is mostly the marketing of the series. Do you remember Motorola advertising these anywhere? Because I sure don’t. Or even if it did, the effort was simply low. There were also some questionable decisions, like having the smaller Motorola Edge phone use a less powerful processor and camera. While it made it the more affordable phone of the two, the price gap wasn’t that big in the end.

So basically, if you bought the smaller Edge, you had to sacrifice not only in terms of size but also in terms of performance. And what about the Edge Plus? Well, this phone was a real flagship, and it also had a flagship price. But the problem is that unless you have a reputation for premium phones, you can’t price yours the same as your competition. If you want people to give you attention despite your poor marketing, you need to undercut rivals by a huge margin or produce a device with much better value-for-money ratio.

That of course didn’t happen, and the first Motorola Edge phones were another two to be added to the brand’s ever-growing list of long-forgotten and unsuccessful flagship phones.

Did Motorola fix its mistakes with the next generation of Edge phones? Well, unfortunately not. It actually got worse, again. While I’ve reviewed both the Edge 20 Pro and the Edge 20, and I have to admit, these were pretty nice and flawless, Motorola made another mistake that set it even further behind Apple and Samsung.

Motorola pulled the plug on its US flagships entirely. The Motorola Edge for the US market was called the Edge (2021) and it was nothing short of a mid-range mediocre device, a high-end phone wannabe to be concrete. The Edge (2021) had even worse specs than the equivalent Edge 20 that was sold in Europe, yikes.

Still, all of this could be forgiven if the phone was priced right, but you probably guessed it, it was not. The Motorola Edge (2021), with its LCD screen, plastic build, and cheap ultra-wide camera sensor, was priced at 699. Yes, 699! The same price as an iPhone 13 mini and only 100 less than an iPhone 13. The same price as a Samsung Galaxy S21 or an iPhone 12, which both had some of the best camera setups and displays on the market.

If that’s not total neglect of the US flagship market or even the smartphone business, I don’t know what is. In Motorola’s American lineup there were dozens of boring Moto G phones, an aging foldable phone that is evidence of another marketing failure, and the half-baked Edge it offers in its home country. Actually, it is the same case in current days too, but with the addition of one more flawed device.

Repeating decade-old mistakes in 2022

What’s going on with Motorola now, you may ask? Well, this year, the brand released the Edge Plus (2022) and the Edge 30. One has two names, one is for the US market and one for the rest of the world, and the latter isn’t sold in America.

While the two names aren’t necessarily a problem, the phone itself is. They did it again guys. Motorola repeated its biggest mistake, the mistake it’s been making for almost a decade now. This mistake was once again the camera.

Not only are the cameras of the 999 Edge Plus (2022) worse than the iPhone 13 and the Galaxy S22 series, but they are also worse than the previous generation of Motorola Edge phones. That’s right. Ditching the 108MP camera setup used in the two previous generations of Edge devices in favor of a newer 50MP one turned out to be a bad move.

See, the new camera system of the Edge Plus (2022) is more upper-mid-range than a flagship. The main camera is good, but not as good as before. The ultra-wide camera is a bit meh compared to rivals, and to add even more salt to the wound, the third camera is a 2MP depth sensor. That’s a sensor also found in a 250 Moto G. It is my professional opinion that whoever thought it was a good idea to price a phone ‘featuring’ a cheap 2MP camera sensor at 999 should probably rethink their line of work. Seriously.

The Edge 20 Pro had a wonderful 8MP periscope with 5x optical zoom and OIS. How can you wake up one day and think that a 2MP useless sensor is any kind of consolation for ditching a camera that was actually one of the key selling points of the predecessor? How?

It doesn’t end there. The Edge 20 Pro was never sold in the US, but I have to note that it was cheaper than this new Edge Plus. In my opinion, it even had a more premium build and much nicer looks. It’s a good thing the Edge 20 Pro is still easily found for sale across Europe. Having the latest flagship processor isn’t the only ingredient you need to make a real flagship phone, it never was.

Is Motorola afraid of competing with Samsung and Apple?

Well, all evidence points to a positive answer to this question. The only logical reason behind the brand’s silly decisions for, but not limited to the US market, is a flagship smartphone duopoly policy.

We still remember vividly the Huawei vs USA fiasco when the company was on its way to debut in America’s phone market. Many conspiracy theories pointed fingers at Apple and Samsung putting pressure on Trump to ban anything Huawei-made so they have this vast market to themselves.

You might be thinking, well, Samsung isn’t a US company, so that couldn’t be it. But actually, it could be considered as one, especially if you think how close its home country is to the USA in terms of geopolitical and business relations. That’s not the case for China.

Motorola is owned by the China-based Lenovo. There’s no overlooking that fact. Even though it is an American brand, there is not so much American left about it. Still, its heritage is what probably doesn’t allow a ban on it (for now), but the idea of a compromising US smartphone lineup so you can keep selling in your country of origin is more intriguing than ever before.

For some reason, Motorola is comfortable with selling and marketing mostly low-end phones in the US, like the Moto G Power (2022).

But enough with the conspiracy theories. Whatever the case, it doesn’t concern the worldwide phone business, where Motorola is also not taking flagships seriously. As I said, the Edge Plus (2022), or the Edge 30 Pro as it is called in Europe, was a big disappointment camera-wise even compared to its predecessor.

Most people who buy flagship phones buy them for the cameras, not so much for the performance anymore, as mid-range phones have become good enough that most don’t even notice a difference compared to their more expensive cousins. Selling a 999 phone with a ‘meh’ type of camera system will never be okay.

In recent months, many leaks point to Motorola fixing this huge mistake by releasing a successor earlier than usual. This successor is said to feature a cutting-edge 200MP camera system, the latest and greatest from Snapdragon, and a new design language that is both modern and prettier.

A Motorola fan can only hope for a miracle at this point. But one thing is certain. If once again the brand doesn’t release its best phone in America, these conspiracy theories of mine will be more plausible than ever.

Is Motorola dead? How can it compete against Apple or Samsung?

The burning question on everyone’s mind is, does Motorola avoid competing with more popular brands like Apple and Samsung? Much to the delight of its fans, Motorola has been focusing on its flagship offerings. However, these devices proved to be mere higher mid-rangers. Notably, higher-end Motorola phones do not hit the store shelves in the USA now. Also, the best phones from the company aren’t available in Europe either.

Motorola seems to have adopted a strategy that involves avoiding competition with the big boys. It appears that the American smartphone segment is dominated by leading manufacturers. over, it is unclear how Motorola plans to coexist with more popular brands in the smartphone market without competing with them. Alternatively, the once-famous brand can completely avoid entering the markets dominated by the likes of Samsung and Apple.

Motorola Flagships Failed To Gain Popularity

During the time it was owned by Google, Motorola released a myriad of great smartphones. Further, these devices had clean UI and received updates regularly. over, the handsets did not have any bugs. The Google Nexus 6 drew inspiration from the 2nd generation of Moto X device. This was a decent offering as well. However, it started getting worse since then, particularly in the US. Notably, Motorola has a loyal fanbase.

However, the company still acts like an outsider. It adopts a disappointing marketing strategy and releases poor-quality devices. To recap, Motorola even tried making modular phones but did not garner popularity among users. Now, the company was likely to make a remarkable comeback into the premium segment with the Moto Z flagship devices. However, Moto Mods, slim bodies, and a unique design didn’t enable Motorola to lock horns with other brands in the premium segment.

Meanwhile, Samsung and Apple have been dominating the smartphone segment. So, why do Moto phones struggle in terms of acquiring the market? One of the reasons behind the failure of the Moto phones is poor marketing. Aside from this, Motorola had to compete with some big brands in a bid to increase its phone sales. A great flagship shouldn’t compromise in any aspect. However, the Moto phones came with an unimpressive camera setup and poor battery life.

Motorola did not abandon its camera systems. In fact, it came up with the Moto Z Hasselblad mod to further enhance the mobile photography experience. However, it did not match the camera performance of Apple and Samsung. Likewise, the Moto Mods required users to stick thick mods to their smartphones. So, several users weren’t willing to do it. The disappointing sales of the Moto Z lineup led to Motorola pulling the plug. However, it all got worse.

Motorola Stops Making Flagships

The company did not launch any other flagship phones in the US during the Moto Z era. Regrettably, the Moto Z lineup had a major shortfall. The concept of the lineup restricted Motorola from improving the new generation. Although they were four generations of Moto Z phones, they were pretty much the same devices. The company had to retain the same design to ensure that the Moto Mods work with each new Z phone iteration.

In other words, each new generation had the same size and shape. over, Motorola used the same material to make new iterations of the Moto Z phones. Designs usually do not last for more than two years in the smartphone business. However, Motorola used the same design for its premium offering for four years. Also, it is worth mentioning here that Apple launched the iPhone X, XS, and iPhone 11 Pro with nearly the same design during these years. So, why this is a problem?

Motorola Is No Apple

Motorola isn’t as popular as Apple. A report by ZDNet suggests that the company tried to be more like Apple after its US market share increased to 11 percent. Also, the company was only 21 points behind the South Korean tech behemoth, Samsung. However, it was 10 points ahead of Google, its former owner. Nevertheless, to be more like Apple, Motorola had to be producing top-notch phones for years. Also, you need to develop a reputation for offering great premium flagships.

Apple’s design didn’t restrict iPhones from adopting design despite using the same body. Apple added new connectors, cameras, and sensors to each new iteration. However, Motorola did not have any of these characteristics. First off, the company doesn’t have its own operating system. over, it did not release the best smartphones for years. On top of that, the Moto Mods didn’t allow the company to redesign the camera module. In other words, this was the Motorola flagship hiatus.

It looks like the company simply failed to understand the smartphone market at the time. Also, Motorola probably didn’t pay heed to what other leading brands were doing.

Lack Of Attention To The Smartphone Market

Motorola eventually realized that the Moto Z series isn’t what people really want. So, it decided to go in a different direction. This paved the way for the Motorola Edge era. The Motorola Edge and Edge Plus went official back in 2020. Both devices sport awe-inspiring designs and offered great specs. Also, they were reasonably priced and had a good camera setup. However, the marketing of the series went wrong. It is hard to even recall Motorola advertising the Edge series anywhere.

Gizchina News of the week

over, Motorola used a less powerful chip and camera for the smaller Edge phone. Although it was the more affordable phone, the price gap wasn’t really big. So, the smaller Edge ended up disappointing in terms of size and performance. However, the Edge Plus was a flagship, carrying a flagship price tag. Regrettably, Motorola is not known for premium phones. So, people weren’t willing to shell out a lot of money on a flagship offering from a brand that has a reputation for making low and mid-range devices.

What Went Wrong?

The company didn’t try to fix its mistakes with the next iteration of Moto Edge phones. In fact, its mistakes set Motorola behind Samsung and Apple. Motorola is currently focusing on clamshell smartphones. There is a lot of hype around its Razr 3 smartphone. However, the device could use the same battery that powered the Razr 5G, which launched in 2020. As a result, it will fail to compete with Galaxy Z Flip 4 which packs a 3700mAh battery in the same body. Now, Motorola entirely discontinued its US flagships.

The Motorola Edge went official in the US as the Edge (2021). However, it turned out to be a mediocre device. In fact, the Edge (2021) offered worse specifications than the European equivalent of the phone dubbed the Edge 20. On top of that, the phone wasn’t even priced right. The Edge (2021) sports an LCD screen and has a plastic body. over, it comes with a poor-quality ultra-wide camera sensor. However, it still carries a price tag of 699. Notably, the iPhone 13 mini retails for the same price. The iPhone 13 costs only 100 more.

The Galaxy S21 and iPhone 12 cost around 699. However, these devices come with superior displays and camera setups. So, it looks like Motorola completely neglected the US flagship market and the overall smartphone business. The company released a series of unimpressive Moto G phones in the US. The company continues to bring flawed devices to the market even in the current days.

Not Learning From Old Mistakes

The company launched Edge Plus (2022) and Edge 30 this year. However, the Edge 30 did not arrive in the US market. over, Motorola made the same mistake it has been making for a long time now. The camera department of Edge Plus (2022) was flawed. Also, the device carries a steep price tag of 999. The camera setup of the new offering is worse than the older Motorola Edge phones. To recap, the previous generations of Edge smartphones featured a 108MP camera setup.

However, the newer phones from Motorola come with a 50MP camera setup instead. So, it is safe to say that the camera setup of the Edge Plus (2022) isn’t quite a flagship. Also, the ultra-wide camera is pretty average compared to competitors. The third camera is a disappointing 2MP depth sensor. The same sensor is available on Moto G, which retails for 250. So, why would people want to shell out 999 on a handset with a cheap 2MP camera sensor?

To recap, the Edge 20 Pro came with an impressive 8MP periscope. This sensor offered OIS and 5x optical zoom. So, it is unclear why Motorola decided to replace an impressive camera with a 2MP sensor. To make things worse, Motorola did not sell the Edge 20 Pro in the US. However, the handset is available for purchase across Europe.

Is Motorola Avoiding Competition From Samsung Apple?

The word on the street is that Apple and Samsung put pressure on former US President Donald Trump to ban Huawei to acquire a large market share. Although Samsung isn’t a US company, its home country is close to the US in terms of business relations. However, China doesn’t have the same geopolitical relationship with the US. Now, Motorola’s owner Lenovo is a Chinese company. There’s barely anything American about Motorola now.

Interestingly, it is still not banned in the US. However, Motorola’s decision to neglect flagships doesn’t affect the phone business globally. Most people are willing to spend a lot of money on flagship phones because they house an impressive camera setup. So, performance is no longer the only key factor when it comes to deciding which phone to buy. However, Motorola is selling a phone with average cameras for a whopping 999. It looks like the company is trying to fix this mistake by launching a successor ahead of its usual timeframe.

This alleged successor will come with an impressive 200MP camera setup. Also, it will pack the latest Snapdragon processor. The device will adopt a newfangled design as well. It will be interesting to see if the purported handset will help Motorola re-enter the high-end smartphone market. Also, it needs to ensure that it releases the best Motorola phones in the US.

The best Motorola phone 2023

Motorola quietly makes some of the best smartphones on the market.

Whether it’s the cheaper Moto G series or the high end Motorola Edge models, you will find a phone for every budget in the line-up.

The company, now owned by Lenovo, produces scores of phones each year, selling different models to different markets. Confusingly, sometimes it releases the same phone under different names in different countries.

Motorola has also recently revived its legendary Razr brand now that folding phones are a reality in 2023. There are more models out for sale than you might think.

That’s why we’ve put together this definitive list of the ten best Motorola phones right now. Most are available for sale in the UK, but some will not be available in the US or parts of Europe thanks to Moto’s sporadic regional release strategy.

If you go for a Moto, you’ll be rewarded with clean design, decent battery life across the board, and some of the best Android software available. The company’s decision to keep it simple and only add truly useful new features on top of basic Android is a winner.

Best Motorola phones 2023

Motorola Edge 40 Pro – Best overall

The Edge 40 Pro is the best Motorola phone you can buy right now. Confusingly, in the US it’s known as the Motorola Edge (2023).

Naming weirdness aside, this is a top-spec smartphone with a Snapdragon 8 Gen 2 chipset, 12GB RAM, a very good 165Hz display that’s truly cutting edge, and a subtle but solid design with matt glass back cover.

That high refresh rate is rare to see on any handset that isn’t a gaming phone, and the Edge 40 Pro makes the most of it with a stunning display. It’s a quad-curved 6.67in beauty. Performance when multi-tasking and gaming is up there with the best Samsung and OnePlus offers on its latest high-end phones, and that’s backed up with triple rear cameras.

Those cameras are the best you can get on a Moto phone but aren’t the very best out there. The classic main, ultrawide, and telephoto set up is decent though and shots with the 50Mp main are sharp and detailed. The telephoto is only 2x so this isn’t the best phone for long-range photography, but does nicely for portraits of people. The 60Mp front facing camera is also pleasingly excellent.

Motorola also packs in fast wired charging and (slow) wireless charging, as well as three years of Android OS updates and four years of security patches. This is only one year behind Samsung, and means we are inclined to recommend the Edge 40 Pro with few caveats.

Motorola Edge 40 – Top tier, great price

- Svelte durable design

- Clever clean software

- Large 144Hz screen

- Good performance

This is a very solid smartphone for £529/€599 (unfortunately it’s on sale in the US currently). We were very taken in our review of how the vegan leather backed handset is lightweight despite the generous screen size, and it’s also one of the thinnest phones we’ve used for some time.

That big 6.55in display has a super smooth 144Hz refresh rate, a spec rarely seen outside of gaming phones. It’s crisp and responsive but not the brightest out there.

One of the best things about the phone is Motorola’s refined and tasteful software skin. It keeps Android uncluttered and clean but adds in useful extras you won’t find on other phones like the intuitive ‘peek’ always on display for notifications and a double flick of the wrist with the phone in your hand to open the camera app.

It’s a shame Motorola only offers two years of Android updates and three years of security patches to 2025, but if that doesn’t bother you this is a well-designed phone with a decent camera and a 68W charger in the box.

Motorola Moto G62 – Best budget Moto

- Tidy hardware software

- 120Hz display

- 5G connectivity

- Strong battery life

- Performance isn’t 120Hz-worthy

- Slow 15W charging

- Camera struggles in less than optimal lighting

This excellent phone is not only one of the best Motorola phones, it’s also one of the best budget phones you can buy, full stop.

For under £200 you get a 120Hz, the usual great Moto software, 5G, and excellent battery life that can stretch to two days with normal use. There are the usual caveats at this price, including less than great general performance, slow charging, and a camera that only really takes great shots in full daylight.

The 6.5in screen has good colour accuracy and is Full HD resolution – but an LCD not OLED at this price, but again, if you aren’t overly fussed about having the best phone possible then it’s perfectly fine for messaging, YouTube, video calls, and everything else.

As it’s a budget phone we don’t think Motorola is going to update its software far into the future, which is a downside, but if you’re not bothered by having the latest features from these updates like pricier phones will, then the G62 is a solid smartphone with a nice looking plastic design at a price you really can’t argue with.